On February 2, 2026, I start my Nasdaq futures read at 06:50 UTC-5, in a Bulenox prop firm scalping context.

On the 5-minute timeframe, I am still below the baseline moving average. Yet price prints a clear bullish push. The trap is right there: short “by reflex” under the baseline, or accept that the context may be shifting.

Before the US Open, nothing truly converges.

The market stays irregular, signals conflict, and I have no reason to manufacture a trade. With Bulenox, waiting is part of the job. I’m looking for an opportunity, not an occupation.

After the Open, behavior changes.

Flow becomes cleaner, structuring moving averages finally realign, and the session moves from “in-between” to an exploitable bias.

I’m going to show you exactly how I make that transition.

First, I use the 5-minute read to define the bias. Then I drop to the 1-minute chart with Dynamic FiboTrend to filter and trigger at the right moment. Let’s go.

February 2, 2026, New York session.

I start my Nasdaq futures read at 06:50 UTC-5, in a prop firm scalping context with Bulenox.

On the first 5-minute chart, I spot a key point.

Price stays below the baseline structuring moving average, yet the market pushes strongly higher.

I do not have the bearish alignment I need to look for short entries.

In this type of configuration, I keep it simple.

I force nothing.

Either the market turns bearish again with a clean alignment of structuring moving averages,

or it breaks decisively higher and I switch into a long plan.

Market context – 5-minute timeframe

On the 5-minute chart, the market gradually builds a cleaner context.

Structuring moving averages tighten up, then begin to tilt to the buy side.

I do not try to anticipate.

I want to see a clear acceleration, then a readable bullish context.

Without that, I prefer to wait.

Waiting until the US Open – 5-minute timeframe

Until the US Open, I stay on the sidelines.

The chart does not offer a clean setup within my method.

I keep a binary scenario in mind: a readable bearish return, or a confirmed bullish breakout.

With a prop firm like Bulenox, I can afford to wait for the right timing.

I am looking for a clean opportunity, not a trade “just to trade.”

Bullish breakout at the US Open, then realignment around 10:30

After the US Open, the market accelerates sharply to the upside.

On the 5-minute chart, I finally see a clear bullish alignment of structuring moving averages around 10:30 UTC-5.

From that point on, I switch into execution mode.

I want a simple, clean entry, with manageable risk.

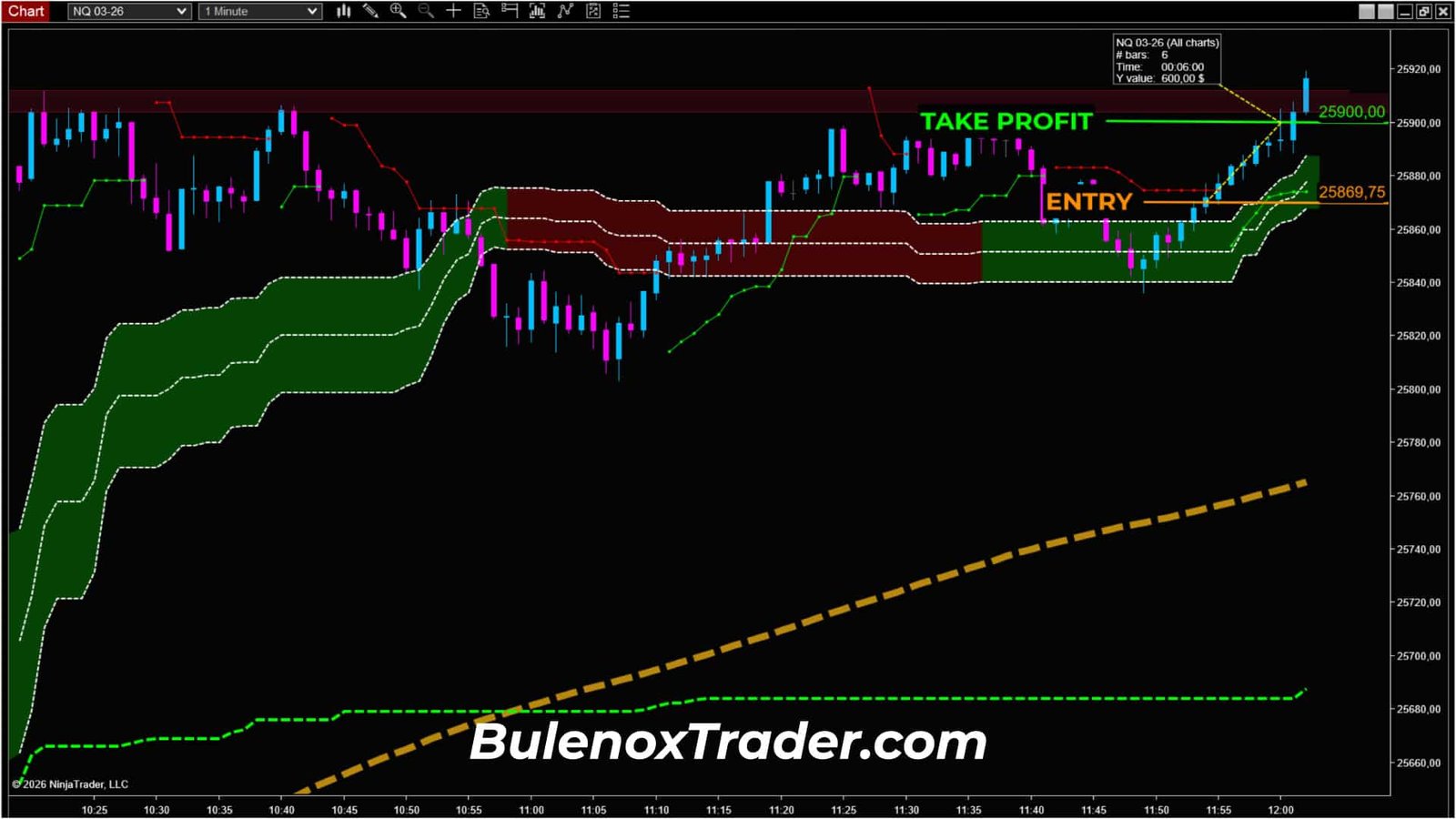

Entry timing – 1-minute timeframe

I switch to the 1-minute chart to refine timing.

The chart, combined with the Dynamic FiboTrend, gives me an exploitable bullish signal.

I do not chase price.

I wait for a clean rejection on the indicator.

An opportunity builds around 11:50 UTC-5.

I prepare my plan.

Entry: 25,870 (long)

Target: just below the last high, around 25,900

I aim for a move of about 30 points.

Simple, readable, without trying to squeeze the last tick.

Exit management – deliberate choice

I exit just before an obvious reaction zone.

The last high remains a sensitive area.

I prefer to secure a clean exit rather than stay exposed to a violent rejection.

Financial equivalence

The move represents roughly 30 Nasdaq points.

- 3 micros: about $180

- 5 micros: about $300

- 1 mini: about $600

These figures are only meant to place the move into perspective within a Bulenox prop firm framework.

Session summary – February 2, 2026

This session highlights one simple point: the market can stay “in-between” for a long time.

The chart shows intentions, but without full alignment, I do not get a clean read.

The real signal comes after the US Open, when the 5-minute context becomes readable.

At that moment, the 1-minute timeframe is used to execute, not to invent an entry.

The job here is patience.

Bulenox gives me the margin to wait for a clear setup.

When the market offers it, I execute, and I exit cleanly.

See you next time.

Peace.

If you want to test Bulenox at a lower cost, you can use the promo code GETFUNDED79 which gives you -79% on the site => Bulenox.com