What Is Trailing Drawdown at Bulenox?

Now, let me briefly introduce myself: code name, Bulenox Trader. Today, we tackle an ultra-crucial and somewhat constraining subject: Trailing Drawdown at Bulenox. This isn’t a mere detail; it’s a rigorous rule you must absolutely understand to succeed in your evaluation and subsequently access withdrawals. We’ll dissect it all: what it is, how it works, and most importantly, how it will influence your trading strategy. Ready? Let’s dive in!

Trailing Drawdown Guide

- Why Bulenox?

- What is a Trailing Drawdown?

- The Impact of Trailing Drawdown on Your Trading Strategy

- Types of Drawdown at Bulenox: Trailing Drawdown and EOD Drawdown

- Details of Funding Accounts at Bulenox

- Comparing Account Option 1 and Account Option 2

- Conclusion: Controlled Flexibility for Responsible Traders

Why Bulenox?

So, why focus on Bulenox? First of all, it’s a reputable prop firm based in the United States, with customer support available from 8 am to 5 pm, US time. They offer funded accounts featuring the famous Trailing Drawdown, a determining criterion if you want to understand the rules at Bulenox. This pushes you to be consistent in your performance. It’s essentially the ultimate criterion to gauge if you’re ready to manage a Master account. But you already know this, which is why you’re reading this article. Anyway, let’s delve into the subject of Trailing Drawdown, as it is the key to everything at Bulenox. Time to get to the heart of the matter.

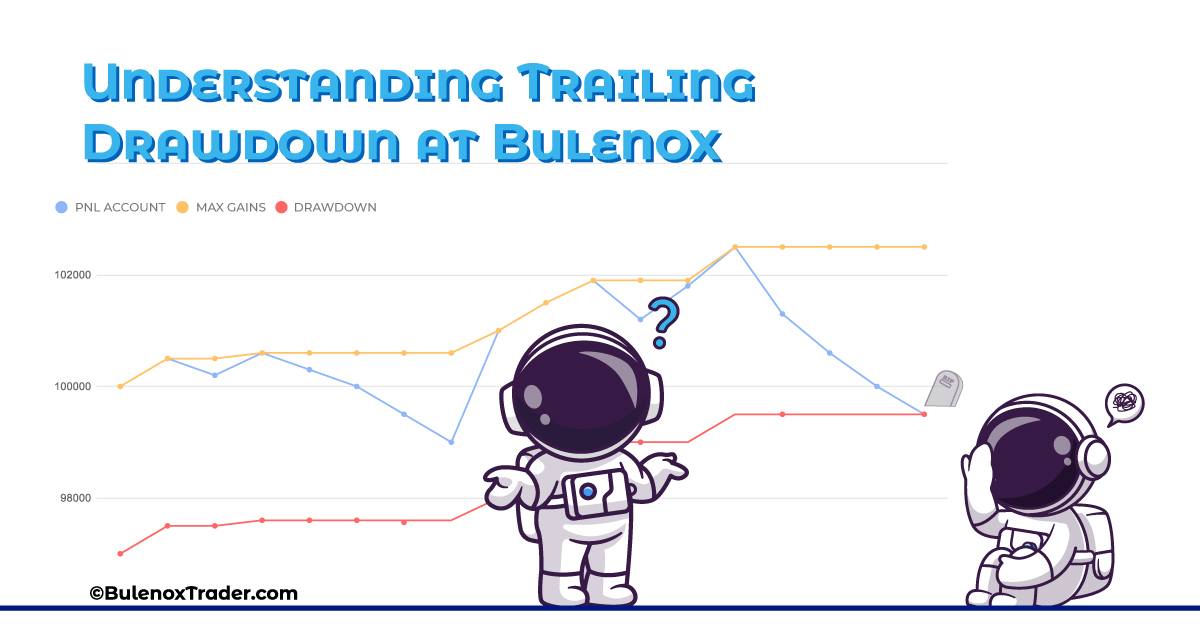

What is a Trailing Drawdown?

Trailing Drawdown is a risk management rule with the potential to transform your trading approach. If you’re new to trading, this term might sound a bit technical. But don’t worry, we’ll break it down for you.

The Concept in Detail

Think of it as a stop loss that evolves with your gains. Yes, it’s an « intelligent » stop loss that knows when you’re making profits and adjusts its level accordingly. The more you win, the higher the Trailing Drawdown rises, thereby protecting your gains.

Comparison with Other Methods

Unlike a fixed stop loss that remains static, the Trailing Drawdown is dynamic. It’s like having a guardian angel for your investments that becomes increasingly lenient as you make good choices. This feature ensures you’re not only maximizing profits but also securing them in a smarter way.

The Impact of Trailing Drawdown on Your Trading Strategy

The Trailing Drawdown can be perceived either as an ally or as an obstacle. It all depends on how you approach it. Some traders see it as a constraint, but the more experienced ones view it as an opportunity to refine their trading strategy.

Advantages and Disadvantages of Trailing Drawdown

Advantages:

- Keeps You on Your Toes: Think of the Trailing Drawdown as a sports coach pushing you to your limits. It encourages you to stay disciplined to avoid rookie mistakes.

- Boosts Your Long-term Strategy: Having this criteria in mind naturally leads you to seek trading methods that are sustainable over the long haul.

- Prepares You for Managing Larger Accounts: By getting used to this constraint, you’re psychologically preparing yourself to manage bigger accounts with greater responsibilities.

Disadvantages:

- Could Limit Your Gains: Be careful. If you focus solely on avoiding Trailing Drawdown, you might miss out on opportunities to make a big score.

- Challenging for Beginners: If you’re new to trading, this criteria can be a bit bewildering initially.

- It’s an Ultimatum: Once you reach the Trailing Drawdown threshold, that’s it for your account—no second chances.

Understanding the pros and cons of Trailing Drawdown will help you decide how to integrate it into your strategy. In the end, how you handle it could be a game-changer for your trading career.

Types of Drawdown at Bulenox: Trailing Drawdown and EOD Drawdown

Option 1: Trailing Drawdown with a $100K Account

So, in a nutshell, Trailing Drawdown acts like a financial seatbelt that moves with you. For more on account types, check out our article: Bulenox:Types of Accounts and Funding Programs.

How Does It Work?

Imagine you choose the $100,000 account with a maximum of 12 contracts and a trailing drawdown of $3,000. As you start trading and climb to, say, $103,000, your trailing drawdown moves with you, going up to $100,000. Simple, right? You take the highest level your account has reached and subtract the drawdown of $3,000.

What If Things Go South?

Let’s say you incur a loss and your account drops back to $102,000. No worries! Your trailing drawdown stays at $100,000. What matters is the highest point you’ve reached. Drop below $100,000, and it’s game over—no more withdrawals. If you’re curious about how withdrawals work, we have a dedicated article: Bulenox Withdrawal: How Do Withdrawals Work?

Option 2: EOD Drawdown with a $100K Account

EOD Drawdown is a bit different. Here, the key figure gets recalculated at the end of each trading day.

Day 1

Suppose you mix good and bad trades and end the day at $104,000. Your EOD drawdown then becomes $101,000.

Day 2

Let’s say the second day doesn’t go as well, and you drop back to $103,000. Your EOD drawdown remains at $101,000.

Day 3

And if on the third day you climb to $105,000? Bingo! Your EOD drawdown moves up to $102,000.

In essence, EOD Drawdown is your best friend when things are going well—it climbs with you. But when things go south, it gives you some breathing room and stays put.

So, are you starting to get the hang of it? With these two options, Bulenox offers you a lot of flexibility but also a fair amount of responsibility. The choice is yours, but at least now you know what to expect!

Details of Funding Accounts at Bulenox

Introduction

After thoroughly covering the fundamentals of trading with Bulenox, such as the pivotal role of the « Trailing Drawdown, » it’s time to explore the various types of funding accounts on offer in greater detail.

Types of Optional Accounts

10K Account

- Who Is It For? Ideal for beginners.

- Monthly Fee: $115

- Trailing Threshold: $1,000

- Daily Drawdown: None

- Benefits: Low starting capital, no scaling penalties, free data fees and NinjaTrader license.

25K Account

- Who Is It For? For traders with some experience.

- Monthly Fee: $145

- Trailing Threshold: $1,500

- Daily Drawdown: None

- Benefits: Ability to switch to more significant capital without Daily Drawdown.

50K Account

- Who Is It For? For more experienced traders.

- Monthly Fee: $175

- Trailing Threshold: $2,500

- Daily Drawdown: None

- Benefits: Greater number of maximum contracts (7) and a higher Trailing Threshold to maximize gains.

100K Account

- Who Is It For? Traders with significant experience.

- Monthly Fee: $215

- Trailing Threshold: $3,000

- Daily Drawdown: None

- Benefits: A substantial starting capital and a Trailing Threshold that allows some flexibility.

150K Account

- Who Is It For? Experienced traders looking to implement more complex strategies.

- Monthly Fee: $325

- Trailing Threshold: $4,500

- Daily Drawdown: None

- Benefits: The highest number of maximum contracts (15 or 150 Micros) before moving to the most advanced option.

250K Account

- Who Is It For? For high-level traders.

- Monthly Fee: $535

- Trailing Threshold: $5,500

- Daily Drawdown: None

- Benefits: The highest earning potential, with 25 maximum contracts (or 200 Micros).

Bulenox caters to traders at all levels by providing a diverse set of account types, each with its own unique set of features and benefits. This variety gives you the flexibility and opportunities you need to achieve success in the trading arena.

Comparing Account Option 1 and Account Option 2

Choosing between different types of trading accounts is crucial for optimizing your performance and managing your risks effectively. Bulenox Trader offers two primary options: accounts with Trailing Drawdown (Option 1) and EOD (End of Day) accounts (Option 2). Let’s delve into the specifics of each to help you make an informed decision.

Option 1: Accounts with Trailing Drawdown

-

Account Types and Fees

- 10K Account: $115/month

- 25K Account: $145/month

- 50K Account: $175/month

- 100K Account: $215/month

- 150K Account: $325/month

- 250K Account: $535/month

-

Features

- Trailing Threshold: Ranges from $1,000 to $5,500

- Daily Drawdown: None

- Advantages: Lower starting capital for beginners, free data fees, and NinjaTrader license, higher potential gains for experienced traders.

Option 2: EOD Accounts

-

Account Types and Fees

- 10K EOD Account: $115/month

- 25K EOD Account: $145/month

- 50K EOD Account: $175/month

- 100K EOD Account: $215/month

- 150K EOD Account: $325/month

- 250K EOD Account: $535/month

-

Features

- Daily Loss Limit: Ranges from $400 to $4,500

- EOD Dynamic Scaling Plan: Varied based on account type

- Advantages: Greater control over daily risks, flexible scaling plans for performance-based growth.

Summary

Both Trailing Threshold and Daily Drawdown are key mechanisms to understand how Bulenox accounts function. These settings allow you to manage your risks effectively while optimizing your potential gains. Therefore, it’s crucial to choose an account that not only matches your level of experience but also your risk tolerance.

Conclusion: Controlled Flexibility for Responsible Traders

Bringing It All Together

By now, you should have a comprehensive understanding of how Trailing Drawdown works at Bulenox, along with the various types of accounts and their specific features. Grasping the concept of Trailing Drawdown isn’t just a prerequisite for passing your Bulenox evaluation; it’s a risk management skill that will serve you well throughout your trading career.

This protective mechanism may seem restrictive at first glance, but it comes with multiple advantages. For serious traders, it provides a means to maintain discipline and build a solid strategy. The different types of accounts are designed to suit varying levels of experience, risk tolerance, and even trading styles.

Time for Decision

So, what’s your move? Are you starting small to get a feel for the platform, or are you an experienced trader ready to take charge of a more substantial account? Regardless of your choice, the important thing is that you now have a much clearer idea of what awaits you at Bulenox.

In summary, Bulenox offers a platform that seamlessly blends flexibility and responsibility, all wrapped up in a professional and serious approach. If you’re up for the challenge, then go for it! Financial markets don’t wait, and with Bulenox, you’re better equipped to face them.

Happy trading! 📈

Time to Take Action

Convinced by the opportunities Bulenox offers and ready to take the leap? That’s great news. Due to our close collaboration with Bulenox, I have an exclusive promotional code to share with you.

🔔 Check out the « Bulenox Active Special Offer » and its associated Bulenox promo code. It gets updated with every new special offer.

Every opportunity is precious in the trading world, and this could be your springboard to the next level. So, why not you?