The Tuesday, January 20, 2026 session starts at 06:50 UTC-5 on Nasdaq futures.

The bearish bias has already been in place since midnight. On the 5-minute timeframe, the structure remains clean, and the structuring moving averages clearly guide price to the downside.

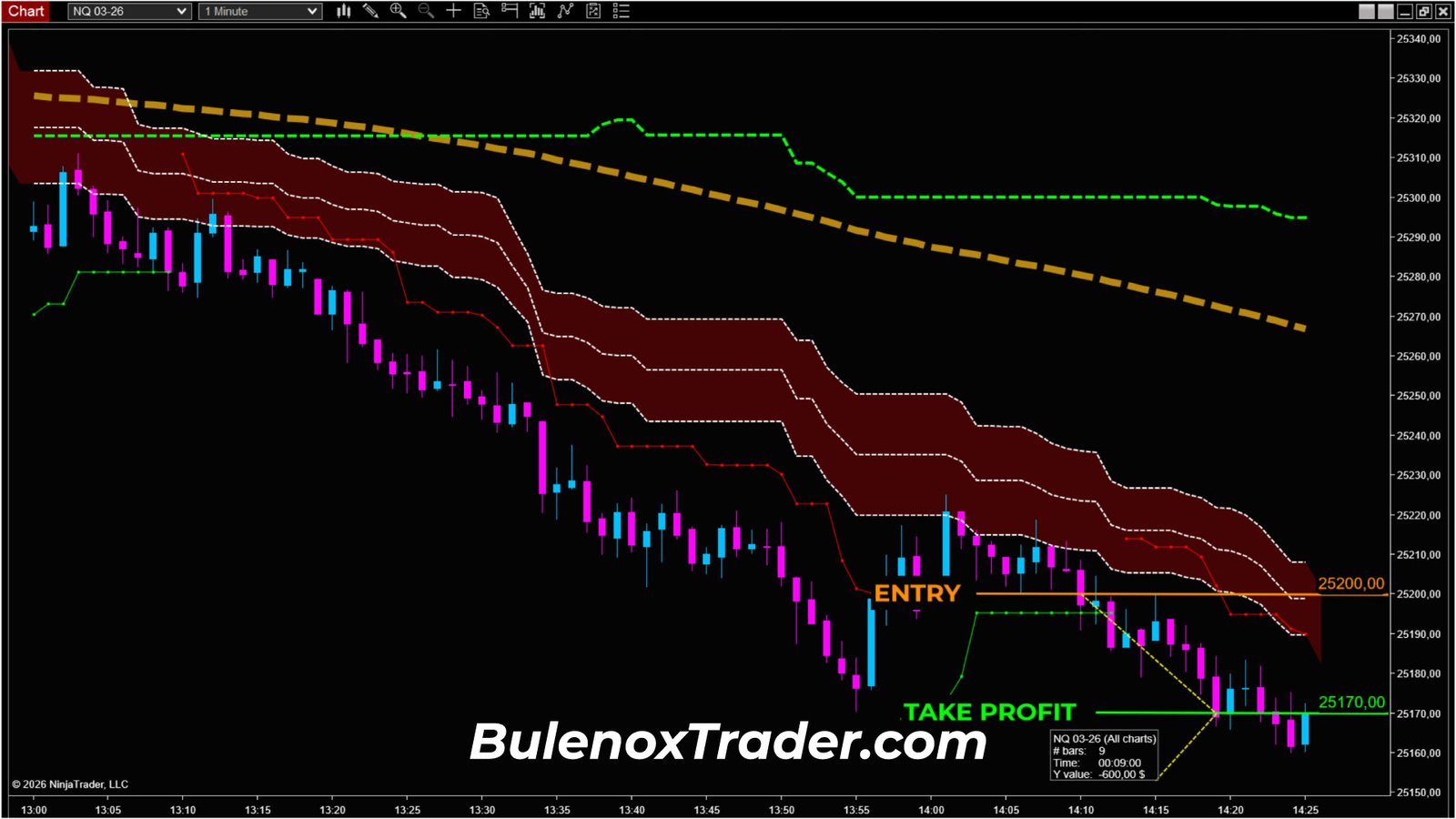

I switch to the 1-minute timeframe to look for an entry point.

The Dynamic FiboTrend offers nothing clean. Price pushes back toward the EMA 100 on the 5-minute chart, and the context shifts into a more complex pullback zone.

The 5-minute Donchian, the 1-minute moving averages, and the FiboTrend fail to converge. I therefore refuse any execution, especially ahead of the US Open.

The real context only appears later, around 14:00 UTC-5.

The 5-minute timeframe finally realigns to the downside. I find a controlled correction and a clear convergence of signals again.

In this context, the capital provided by Bulenox serves above all one useful purpose: waiting.

I then break down the entire setup in detail in this presentation.

January 20, 2026, New York session.

I start my Nasdaq futures read at 06:50 UTC-5, within a prop firm scalping context with Bulenox.

From the very beginning of the session, the bias is clear.

The market is trading within a bearish trend that has been in place since the start of the day, almost since midnight.

Market context – 5-minute timeframe

On the 5-minute chart, the structure is clean.

The structuring moving averages clearly guide price to the downside.

As long as price remains below the baseline structuring moving average, my plan is simple.

I am only looking for short setups.

My framework is defined.

Up to the baseline moving average, I work strictly with a bearish bias.

Above that zone, the context would become more complex.

In that case, I would not insist.

Either the bearish bias would reassert itself, or the market would flip decisively bullish.

Timing search – 1-minute timeframe

I then switch to the 1-minute chart to look for an entry point.

On this chart, the Dynamic FiboTrend gives me nothing.

No exploitable signal.

The signal is bullish, with potential long entries if this were a bullish-bias scenario.

Price is pushing toward the baseline EMA 100 on the 5-minute timeframe.

As price approaches that area, I switch into complex pullback mode.

The read becomes uncertain.

As you can see on the chart, several elements conflict with each other:

- the Dynamic FiboTrend flips bearish,

- price is trading above the 50% level of the Donchian channel on the 5-minute chart,

- the structuring moving average on the 1-minute timeframe is flat and heavily worked,

- the context is close to the US Open.

Even though a bearish signal appears on the Dynamic FiboTrend, it remains isolated.

It is not supported by the full validation system.

So I do nothing.

I let the market decide.

This is also one of the advantages of prop firm trading.

There is no reason to force a position.

With capital funded by Bulenox, waiting is an integral part of discipline.

Market reconfiguration – around 14:00 UTC-5

Eventually, I have to wait until around 14:00 UTC-5.

At that point, the 5-minute chart finally shows a clear realignment of the bearish context.

Flows become readable again.

I return to the 1-minute chart to look for an entry.

This time, the chart combined with the Dynamic FiboTrend delivers a clean signal, with:

- a clear bearish bias,

- a controlled correction,

- signal convergence.

Timing becomes coherent when reading the chart.

Execution and exit

The short entry is taken around 25,200, with a break and retest of the level for confirmation.

I aim for a simple target, without seeking excessive extension.

👉 Exit around 25,170.

I can expect a clean trade from start to finish.

As shown on the chart, the structure allows for calm position management.

The trade is eventually validated.

Financial equivalence

The move represents approximately 30 Nasdaq points.

- 3 micros → ≈ $180

- 5 micros → ≈ $300

- 1 mini → ≈ $600

These figures are only meant to put the move into concrete terms and help you relate it to your daily objectives.

Session summary – January 20, 2026

This session perfectly illustrates a common reality.

The underlying bias is clear very early, but the timing is not immediately exploitable.

Part of the morning unfolds in a context of partial signals.

Some indicators suggest potential paths, but the full system does not converge.

In this type of configuration, intervening means forcing a read.

The opportunity only appears later, when the market truly reorganizes.

From that moment on, the structure becomes readable, risk manageable, and execution aligned with the method.

This session reminds us of a simple truth:

it’s not the number of signals that creates an opportunity, but their alignment.

When the market offers it, you just need to be ready.

See you next time.

Peace.

If you want to test Bulenox at a lower cost, you can use the promo code GETFUND89 which gives you -89 % on the site => Bulenox.com